You are viewing 1 of your 1 free articles

NHG hits 40% of milestones in plan to return to compliance

The latest trading update from Notting Hill Genesis (NHG) shows that the landlord has hit 40% of the milestones in its plan to return to compliance with the English regulator.

In this update for the six months to the end of September, the 67,500-home group said it was “making steady continuous progress across all workstreams in our regulatory compliance plan and all milestones due in quarter two of 2025-26 have been delivered”.

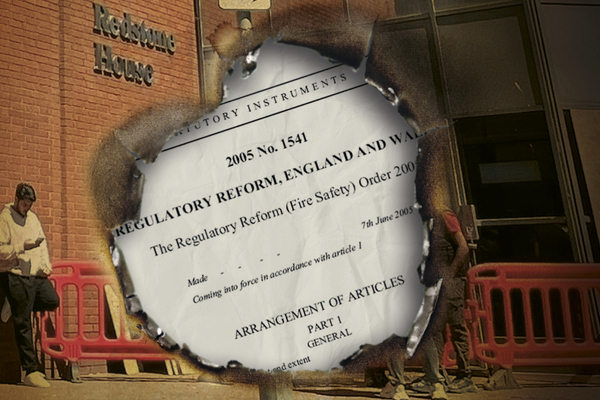

NHG was downgraded to G3 by the Regulator of Social Housing and handed a C3 rating for consumer standards following “serious failings” in November last year.

Patrick Franco, chief executive officer at NHG, said: “As an organisation undergoing a significant transformation, I am pleased with the progress we have made in the first half of the financial year.

“We have strengthened the fundamentals of the organisation, increased our investment in residents’ homes and improved the service we provide, while also maintaining a robust financial position.”

On the regulatory front, the percentage of buildings with both an in-date fire risk assessment and no overdue actions has increased to 90% in quarter two, up from 75.7% a year ago.

In preparation for Awaab’s Law, the landlord said it had “significantly reduced the number of homes affected by damp and mould from 2,635 cases to 1,952 and [currently has] no outstanding Category 1 cases”.

In addition, stock condition surveys have been completed on just over 77% of its homes in the last five years, and NHG described its building safety programme as “on track and within budget”.

Remediation work is expected to be complete on six blocks in the first half of the year, and has been started on a further two. Nine more blocks are due to be remediated in the remainder of the financial year.

As NHG works towards regulatory compliance, turnover was down 3.5% for the period to £350m. This was primarily driven by delays in development schemes.

NHG started 28 homes on site, and 525 homes were completed.

Pre-tax surplus was also down from £37.4m to £23.3m. Investment in NHG’s existing stock was down more than £100m, but still tops £1.08bn.

The London landlord told the stock market: “We maintained a disciplined approach to costs, despite seeing year-on-year increases resulting from inflationary rises, and are targeting further efficiencies in the year ahead.

“Our operating surplus is down year on year due to the timing of this trading update in relation to recognition of service charge income compared to last year.”

NHG more than doubled the homes it sold compared to last year with 89 home sold, which is in line with its new build shared ownership sales programme.

This is the latest update since September, where the landlord revealed a widening of its annual deficit to £130m after fire safety provisions and a revaluation of its build-to-rent assets took their toll.

Mr Franco added: “Looking ahead, we have clear plans in place to maximise operational efficiencies by focusing our activities on London, to continue deleveraging through strategic asset disposals and to improve the quality of our residents’ homes, powered by £800m investment over the next 10 years.

“We remain on track to deliver these plans, to deliver growth in 2025-26 and to further strengthen our financial resilience in the years ahead.”

Sign up for our regulation and legal newsletter

Already have an account? Click here to manage your newsletters

Latest stories